Expanding into new markets is not only a strategic need for forward-looking e-commerce companies but also a reality of the hyperconnected global economy of today. Companies have to reach high-growth markets as competition gets more fierce and use ...

Explore In-Depth CEO Insights and Articles

Explore our extensive collection of articles featuring the latest insights, trends, and success stories from top business leaders. Stay informed with expert analysis and in-depth content that covers a wide range of topics in leadership and innovation. Browse now to stay ahead in the business world.

Browse Our Latest Articles

Explore the latest articles, featuring expert insights, groundbreaking innovations, and success stories from visionary business leaders. From leadership strategies to industry trends, our articles deliver the knowledge you need to stay informed and inspired. Dive in and stay ahead in the ever-evolving world of business leadership.

Send Me a Sample (SMaS) is reshaping the digital sampling landscape, turning digital interactions into personalised, real-world connections.

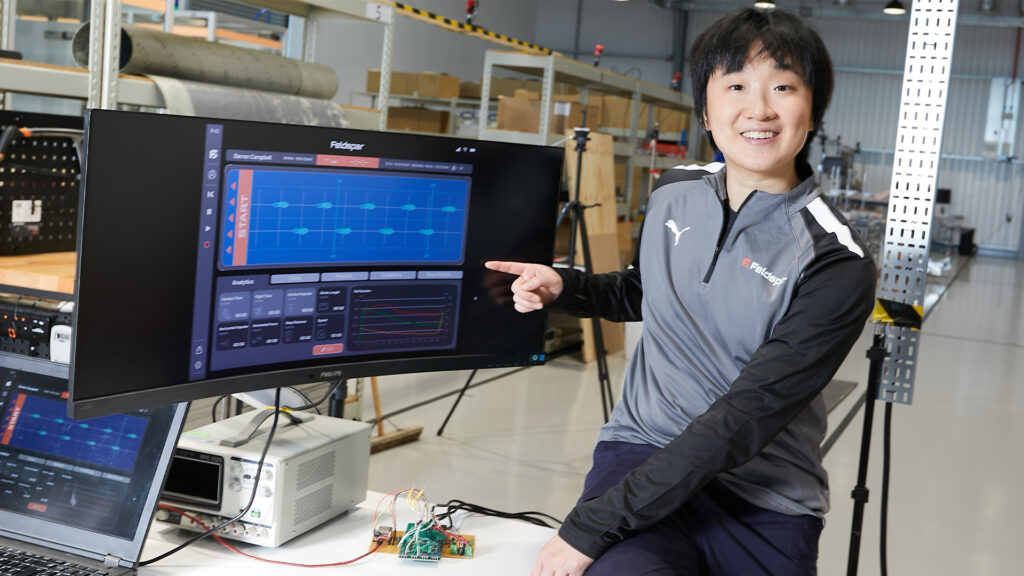

Every element matters in the competitive world of athletics, right down to the flooring. While there have been numerous advancements in footwear, clothing, and accessories to enhance athletic performance, the true potential of flooring remains unr...

Changeblock is a company on a mission to empower businesses to survive and thrive in global markets.

Working with Fortune 500 leaders, startup founders, and executive board members, Olivia Dufour is reimagining leadership as a whole.

With over 25 years of experience in commercial business, Tracy Clark has steadily become an impactful expert in the world of business coaching.

In an era where digital transformation is no longer optional, Heirloom Computing is revolutionizing how Global 2000 companies modernize their critical mainframe systems.

Crucial to any organization is the presence of cohesion. Everyone knows what they’re supposed to do, taking care not to overshadow another co-worker’s responsibilities and assignments. For this reason, open communication must be foster...

A worker slips and falls while lifting heavy boxes at a warehouse. The pain is immediate, and the injury is serious. A trip to the emergency room confirms that surgery and months of physical therapy are needed. But with medical bills piling up and...

In today’s fast-paced digital world, your business is heavily reliant on different technology systems. Tech audits play a huge role in making sure that your business's technology and network infrastructure are in top shape at all times ...

Technology plays an essential role in business success, but it needs to align with company goals to be truly effective. Many businesses invest in IT solutions without ensuring they support long-term growth. When technology is not planned carefull...

Dealing with a company’s finances can leave you in for a bit of a wild ride. Things can plod along easily enough for quite some time, but then it only takes a relatively short period of market turmoil or any number of other issues to leave y...