Finance Firm Secures Success

The world of finance is changing daily, with fintech altering how many people use their money. For the team at FV Bank International Inc., there was a clear gap in the market for those wanted to seamlessly integrate digital assets, fiat currencies and domestic and international payment needs in a single solution. So that’s what they did. Under the leadership of Miles Paschini, they have thrived. We look more closely at why.

Miles Paschini has been part of the fintech industry all his career, and spent much of it exploring ways of disrupting industries. In the late 90s, he was developing industry changing prepaid systems, by 2014, he was the co-inventor of the first prepaid debit cards which were linked to cryptocurrencies and now at FV Bank, he is disrupting the banking industry itself.

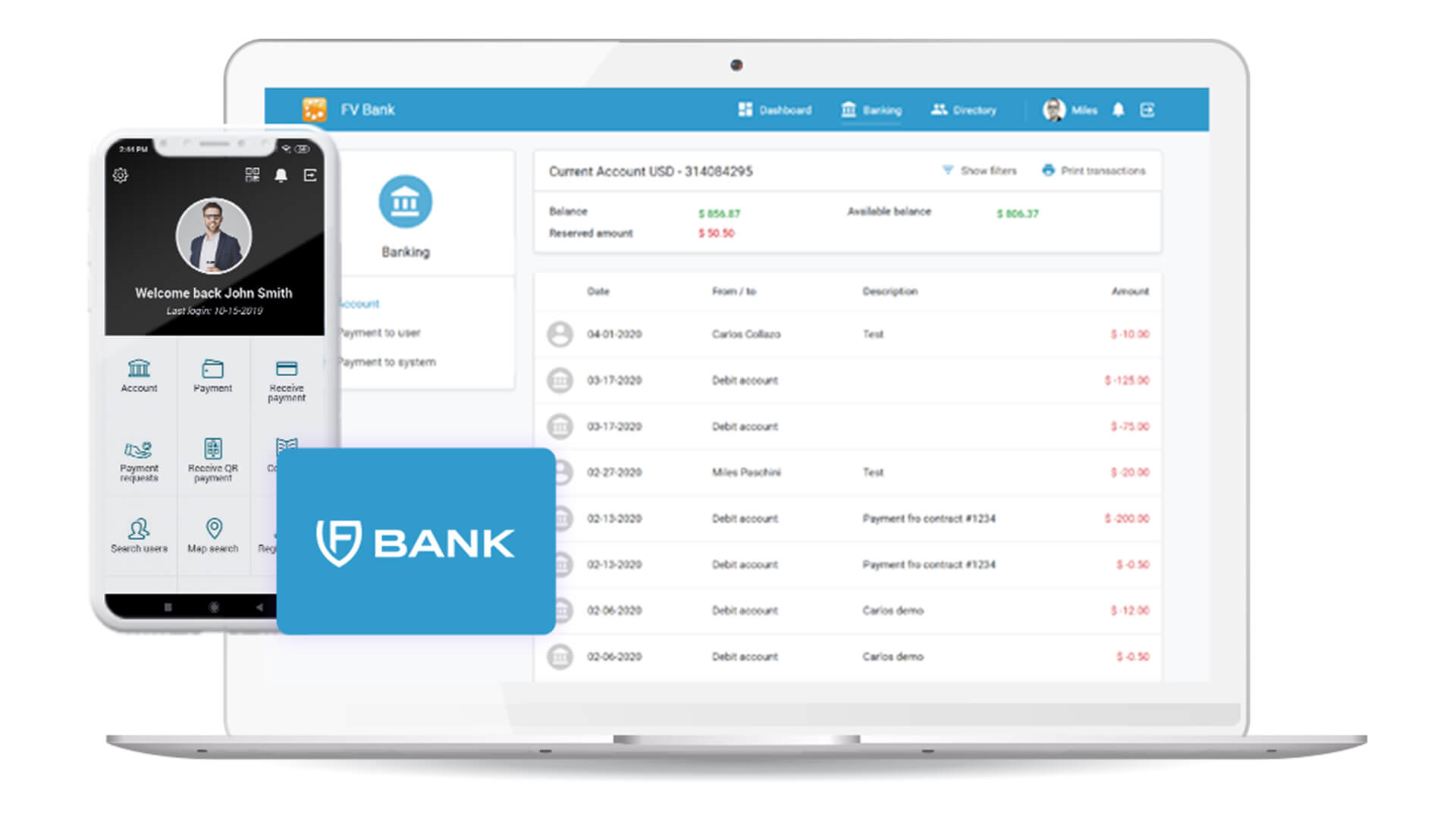

FV Bank is a global digital bank which is transforming the way individuals and businesses interact with banking. Drawing together the disparate services of digital assets, fiat currencies and domestic and international payment, Miles and his team have embraced the potential of technology. In fact, the FV of the firm’s title stands for Fintech Ventures. They are hoping to find ways to leverage new ways of thinking in a compliant infrastructure.

As a fintech firm, it’s easy for the team to claim clients all over the world, with many coming from Asia, Europe and Latin America. The growth of FV Bank is incredible, especially in the team’s target markets. Of course, this is thanks to their innovative approach with many traditional banks unable to keep up with the modern compliance tools used by FV Bank. Most do not have staff who are trained in blockchain, so it makes sense that they cannot support business lines which they do not understand.

In many ways, this differentiator encapsulates what Miles and his team are doing that has allowed them to achieve such success. The strategy of the firm has always been to think to what will be common in a year’s time and to build that tomorrow. FV Bank, therefore, did not start with how the banking world functions today at its core, but with the need to embrace emerging finance technologies within regulatory and compliance framework. This required a great deal of flexibility and determination in order to achieve the desired results.

As the team looks ahead, they see a future of immense possibility. 2020, and the COVID-19 pandemic, was weathered incredibly well, with the firm launching in July. Despite this challenge, the team have done the remarkable and thrived. 2021 will see the rollout of integrated bank accounts with fiat currency and cryptocurrency accounts side by side. FV Bank is very rare in that it has a bank license and digital asset custody license, so the best of both worlds can be offered to customers.

When FV Bank was established, it was to be the bank of next year, today, and being able to hold the currency and digital assets in a single regulated account for customers is key to this. The result is certain to be a much safer, user friendly and modern way of banking. It’s a credit to Miles’ tenacity and dedicated in the field, but it is far from his ultimate goal. As a serial entrepreneur, he is always looking for the next big step that can improve people’s lives and, naturally, return his shareholder’s investments. FV Bank is remarkable, but it’s just another brick in the wall for this incredible businessman.

For business enquiries contact Miles Paschini at FV Bank International Inc. via email at [email protected] or via their website www.fvbank.us.

Stay updated with our latest publications.

Discover Issues

See how we can help you grow in the online space!

Advertise With Us

We can help promote your business.

Find Out More