How Mobile Banking Apps are Transforming Personal Finance Management

Article written by Tatsiana Kuchminskaya, CFO at Andersen

The rise of mobile devices has led to a monumental shift in how people manage their personal finances. No longer tethered to brick-and-mortar banks or limited by business hours, consumers now have banking and money management capabilities 24/7. The popularity of online banking platforms keeps on growing steadily, with the Asian market being the largest. Statista predicts the number of active users will reach nearly 1 billion by 2024, evidencing the rapid adoption of digital finance tools across the globe.

Mobile banking is a huge part of the entire online banking as more and more people prefer to carry out their daily operations via smart devices instead of PCs. Modern feature-rich phones and tablets help individuals and households budget, save, invest, and carry out key banking operations. The unparalleled convenience and flexibility they offer open vast opportunities for personal finance management.

Let’s find out the key benefits of mobile banking apps, the most critical features that set leading platforms apart, and how these innovations are positively impacting spending and saving habits on an individual level.

The benefits of mobile banking apps

First, let’s see why these apps are beneficial. Mobile banking solutions provide a multitude of advantages that enhance how consumers can manage, track, and optimize their finances. By offering robust financial capabilities in one digital product, these platforms offer an unparalleled level of convenience and efficiency.

- Round-the-clock accessibility

One of the most apparent benefits is the ability to access your accounts anywhere, anytime. You don’t need to stick to bank hours or search for convenient branch locations anymore. Mobile banking allows you to view balances, transfer funds, pay bills, and more 24/7. This on-the-go accessibility allows consumers to address financial needs whenever they need or want, whether reimbursing a friend, checking their available balance before a large purchase, or ensuring bills are paid on time.

- Enhanced personalization

Besides convenience, mobile banking apps provide easy-to-personalize tools to simplify money management. Many platforms offer customizable alerts and notifications so that users can stay on top of their finances effortlessly. These can include low-balance warnings, due date reminders, or alerts for transactions over a certain amount. Automated savings features are also common, like auto-transfers to savings accounts. You can set up everything yourself and enjoy seamless banking.

- Building sound spending habits

Mobile banking technology significantly enhances budgeting and spending tracking. Users can review up-to-the-minute information on their income, bills, and expenditures. Advanced analytics give insights into spending habits and trends. By managing finances via one intuitive platform, consumers can better understand where their money is going.

- Seamless money transfers

Mobile banking also enables sending money easily. Rather than writing checks or going to the nearest ATM, you can send money directly to your friends and family with just a few taps. So, it doesn’t matter where you are located anymore. If you want to help someone in need or, vice versa, urgently need a certain sum yourself, mobile banking is very helpful.

- Enhanced security

Don’t be afraid to carry out transactions online. Modern banking apps have top-level security mechanisms. These include card locking and multifactor authentication. So, even if something goes wrong, you can quickly take measures and avoid money loss.

In summary, mobile banking provides unmatched convenience, more profound insights into finances, robust money management tools, enhanced security, and overall empowerment. Consumers can address their needs in real time, track spending effortlessly, send funds digitally, and safeguard accounts. In the future, mobile banking apps can become the number one way people handle their finances.

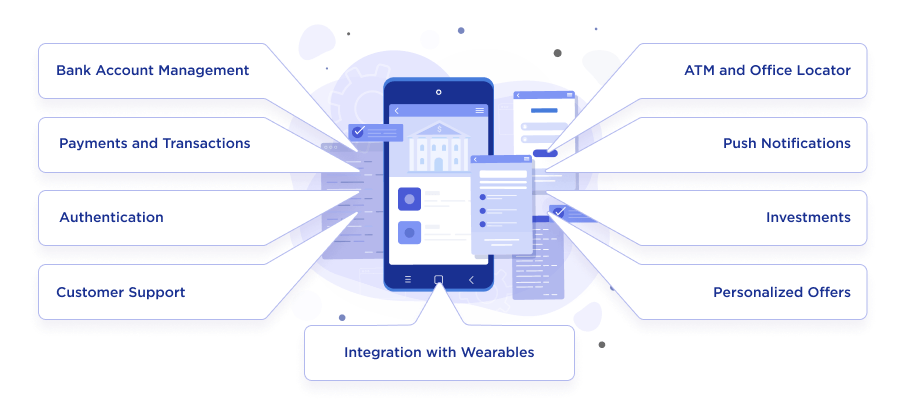

Key features of top mobile banking apps

Here are the most important features of such solutions:

- Peer-to-peer transactions

Seamless money transfers between individuals are a hallmark of leading mobile banking platforms. Integrated peer-to-peer services like Zelle allow users to securely send and receive funds instantly. This convenience eliminates the need to visit ATMs or exchange cash when paying someone back.

- Split payments

Split payment capabilities simplify dividing bills or expenses between groups. Users enter the total amount and the app handles individual payment requests and calculations. This saves time, reduces awkwardness, and enables seamless peer-to-peer transfers.

- Financial planning and management tools

Robust budgeting and expense-tracking tools are also essential. Users can review real-time breakdowns of income, bills, and spending through detailed analytics. Charts showcase trends and habits over customized periods. You can set goals for savings, budgets, or paying down debt. By centralizing finances, consumers gain full control and visibility.

- Remote check deposit

This feature is now commonplace through smartphone cameras. Users simply capture images of checks through their banking app, eliminating the need to visit a branch. Deposits are processed quickly, often within one business day. This is a major time-saver.

- Subscription management

Direct subscription management through the banking app provides spending oversight. Users can easily track, edit, or cancel subscriptions that are charged to their accounts. This simplifies financial organization rather than relying on third-party subscription apps.

- Open banking APIs

These allow linking external accounts and services to share data at a user’s request. This provides a unified view of finances across institutions. Users benefit from seamless money movement, integrated experiences, enhanced analytics, and more.

- ATM locators

This feature is very convenient when you search for the nearest in-network ATM to withdraw money or carry out any other operation. GPS integration allows distance and location filtering to pinpoint options.

- Financial insights and analytics

Personalized insights, powered by transaction data and analytics, enable better spending and saving decisions. Users receive tailored guidance based on their habits. For example, bill payment reminders prevent late fees. Intelligent algorithms provide guidance on budgets.

- Secure authentication

Advanced security features like biometric login and instant debit/credit card toggling provide protection. Alerts notify customers of potential fraud, account changes, and other activities in real time. Customers can also quickly lock cards if a device is lost or stolen.

- AI chatbots

These virtual assistants provide personalized help and convenience. They function 24/7, offering qualitative support for common queries and tasks, enhancing the user experience. Chatbots can check balances, guide users through transactions, provide account history, and more.

- Clear in-app notifications

Well-designed notifications keep users informed without feeling overwhelmed. They include alerts on low balances, upcoming bills, suspicious activities, and other events. So, even if you have forgotten to pay for certain services, your app will help you avoid delays.

- Green banking features

Many banks are integrating eco-friendly capabilities that promote sustainability. Carbon footprint calculators estimate a user’s CO2 emissions based on spending data. Advanced tools provide personalized tips on how to change spending habits and reduce environmental impact.

In the future, even more features may emerge. Solutions may vary, but the common goal is clear. They all help consumers to optimize their financial lives.

Top-notch apps

The variety of banking apps is striking as any aspiring financial institution strives to get one. Let’s see a couple of examples listed by Forbes Advisor. This trustworthy source employs a rigorous set of criteria that encompasses user-friendliness, security, features, and accessibility.

- Citi Mobile

Citi Mobile holds the top position for good reason. Its intuitive interface accommodates both tech-savvy and novice users alike, making navigation seamless. But its standout feature is advanced security. Employing multiple layers of protection, including biometrics, this solution safeguards your data. You can also set up real-time alerts for any suspicious account activity. Moreover, Citi Mobile is packed with useful features like checking your balance, tracking your FICO score, setting savings goals, locking your debit card, transferring funds, and managing bill pay. It even grants a quick peek at your Citibank accounts without logging in. And customer service is just a tap away if needed.

- Bank of America

The Bank of America app offers standard features: you can manage accounts, activate cards, deposit checks, or pay bills. However, several capabilities make it stand out. An integrated spending tracker and budgeting tool help you gain control of your finances. A security meter assesses your fraud risk and provides tips to minimize it. A virtual assistant named Erica can assist with transactions, bills, and spending insights.

- Chase Mobile

Financial wellness starts with awareness. Chase Mobile brings tools for money management and financial health into one platform. The “Credit Journey” feature provides free credit scores and reports to track progress. A built-in budget planner analyzes spending and spots savings opportunities. An investment tool enables portfolio viewing and trading on the go. You can also track and redeem credit card rewards in-app.

Conclusion

Mobile banking applications have become indispensable in our lives. Leading platforms provide unmatched convenience, increased security, and real-time insights into spending and saving. With technology partnerships from application development services companies, banks can continue optimizing mobile experiences, promoting user financial wellness, and delivering the future of banking into the palm of your hand.