The Vital Importance Of Healthy Cash Flow For Small Businesses

The most common reason for small businesses folding is down to cash flow problems. Failure to carry out proper market research, or overestimating demand for a particular product, also causes businesses to collapse. But, cash flow is usually the biggest reason.

Cash flow and profit – understanding the differences

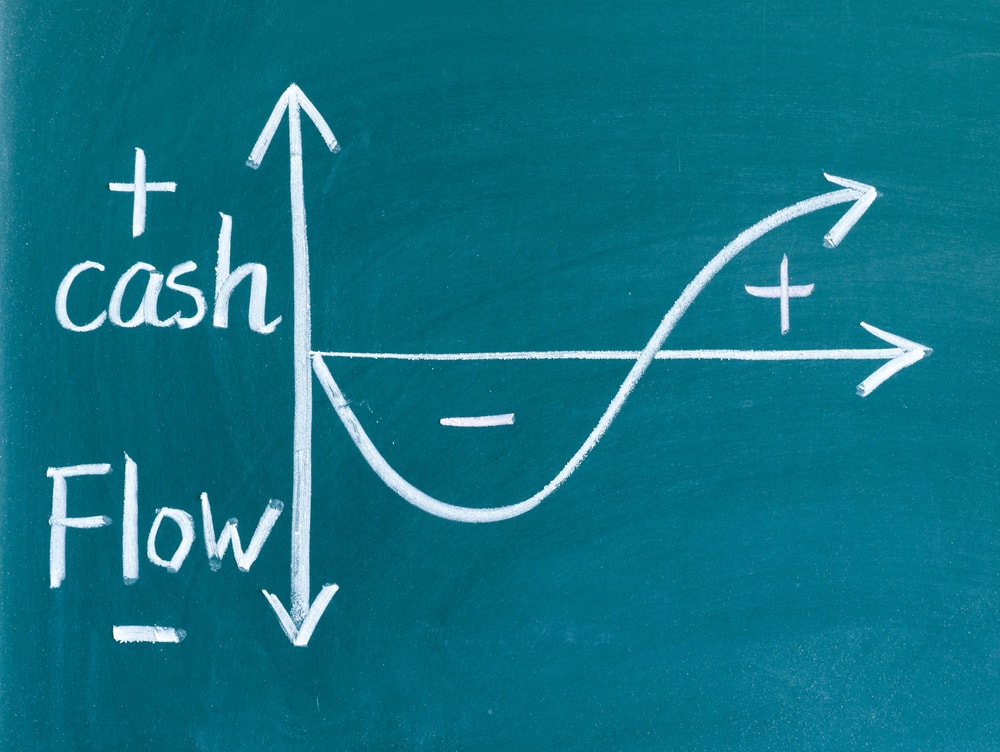

Cash flow is all the money that moves through a company from sales and expenditures. While profits are the money that is left over once all financial obligations have been paid.

One very important metric for profitability and operating efficiency is the cash flow margin ratio. The cash flow margin shows how efficient a business is. If you take the business’s cash flow operating costs and divide them by net sales, you will get your cash flow margin.

The higher the cash flow margin, the more likely a company will remain profitable. For profitability and operating costs, the best percentage calculator will help with clear results. But, here is a simple explanation of how to calculate cash flow margins.

How does cash flow impact small businesses?

The cash flow margin ratio gives a good indication of how well a business is turning its sales into profits. However, cash flow affects many areas of a business and can impact operations heavily.

- Late payments to suppliers

- Unable to restock

- Unable to pay employees

- Credit rating damage

- Additional loans

- Unable to grow

- Cutbacks and layoffs

Businesses that suffer from poor cash flow will find that they miss the opportunity for expansion, and may even have to downsize. Late payments to creditors and suppliers lead to poor relationships and possible damage to credit scores.

Being unable to restock products or raw materials will see production and sales grind to a halt. And there will be a negative effect on the workforce and productivity as a whole.

Poor cash flow often leads small business owners to seek further financing and credit. This option may prove worthwhile, but it has the potential to cause far more problems with profitability and cash flow down the line.

How to manage cash flow effectively

The current economic climate is one of high inflation and a possible recession. Businesses must find ways to offset inflation and survive the crisis.

Calculating revenue and going over all expenses is the best place to start improving cash flow. Creating a cash flow budget will give an estimated view of how the business will operate financially in the coming months. Although a cash flow budget only estimates future income and expenditure, it is a useful tool to utilise.

Dips in income due to seasonal changes can be included in a cash flow budget, as can expected rises in expenditure. Increasing stock of low-cost items can offset inflation. Purchasing materials that are expected to go up in price will reduce expenditure later on.

The importance of managing invoices and payments on time

All businesses will have accounts receivable. These are payments outstanding for services rendered, or goods supplied. Commonly, invoices are sent out after a customer receives their goods, and they will be given a set time frame to pay.

It is normal in business to allow a customer anywhere from 14 days to 90 days to settle an invoice. 30 days is a typical time frame for payments to be made. When payments are made on time, businesses will enjoy regular cash flow. In turn, the business can use the money flowing into it to fulfill its own financial obligations. And the cycle continues.

However, when accounts receivable are overdue, then it can hamper cash flow for small businesses. Global enterprises have far more resources at hand than small business owners, and when payments are delayed, it can be fatal.

Fortunately, there are several options for small businesses to improve cash flow.

Options for improving cash flow in small businesses

Cutting costs is certainly an option to reduce expenditure. But, how to save on costs without cutting quality?

A few options for small businesses are these:

- Renegotiate with suppliers

- Increase prices- Carry out a promotion

- Incentivise early payments

- Introduce extra payment options

- Automated invoicing and reminders

- Use factoring

- Add call to action on digital invoices

- Carry out credit checks

- Ensure invoices and delivery notes are all accurate

Launching a promotion or increasing prices may result in a quick cash flow boost. But, promotions are short-lived, and price increases can alienate customers. It may be much better to look at how you are managing invoices and payments and make changes.

Automated invoices

Setting up an automated invoicing system will reduce the chances of manual error, and speed up payments. Automating this area means that invoices will be sent out on time and tracked. If payment isn’t received, then a reminder will be automatically sent out.

Digital invoices and call to action

Sending automated digital invoices to clients allows the option to include a call to action. A clear link on the invoice to ‘pay now’ for instance could result in quick payment. Adding in an incentive such as ‘pay now for a 5% discount’ will help speed up payments and improve cash flow.

Use factoring

If your business is struggling with cash flow problems, and has a number of accounts receivable, then invoice factoring might be an option. A factor is a type of lender who offers to loan money to a business against accounts receivable. In return, the borrower pays a commission and fees.

Because factoring is short-term and set against money owing, it is often seen as a better option than taking out extra loans.

In summary

Some studies indicate that many small businesses would last less than a month on their cash reserves. Cash flow is critical to the survival of small businesses, and their future development.

While many small businesses struggle with cash flow, there are options available to improve liquidity. Offering incentives for faster payment, and renegotiating contracts with suppliers, can help reduce expenses and bring in cash quickly.